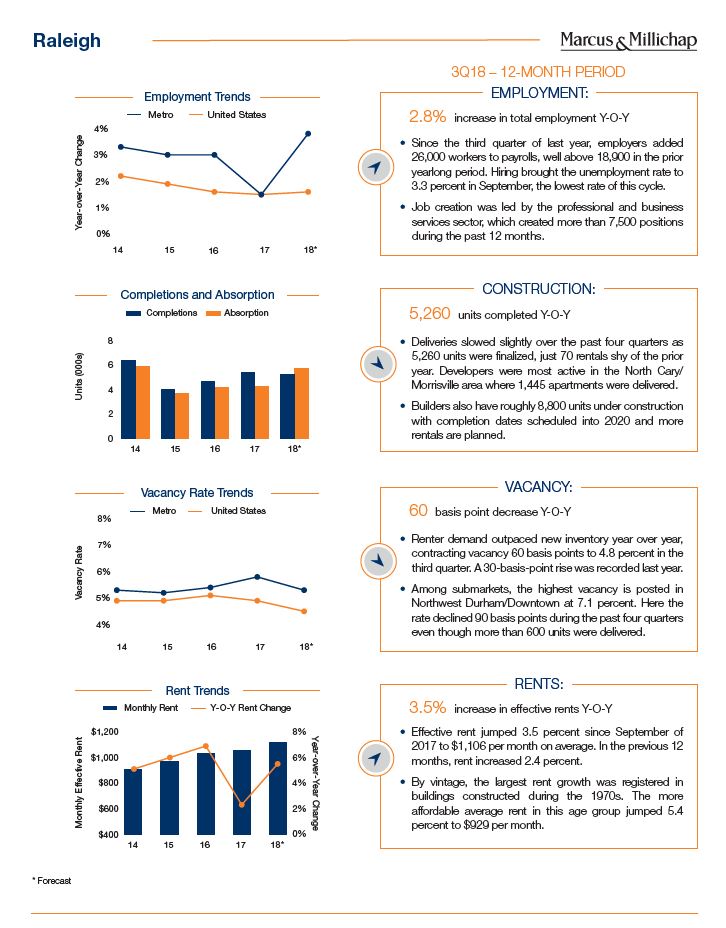

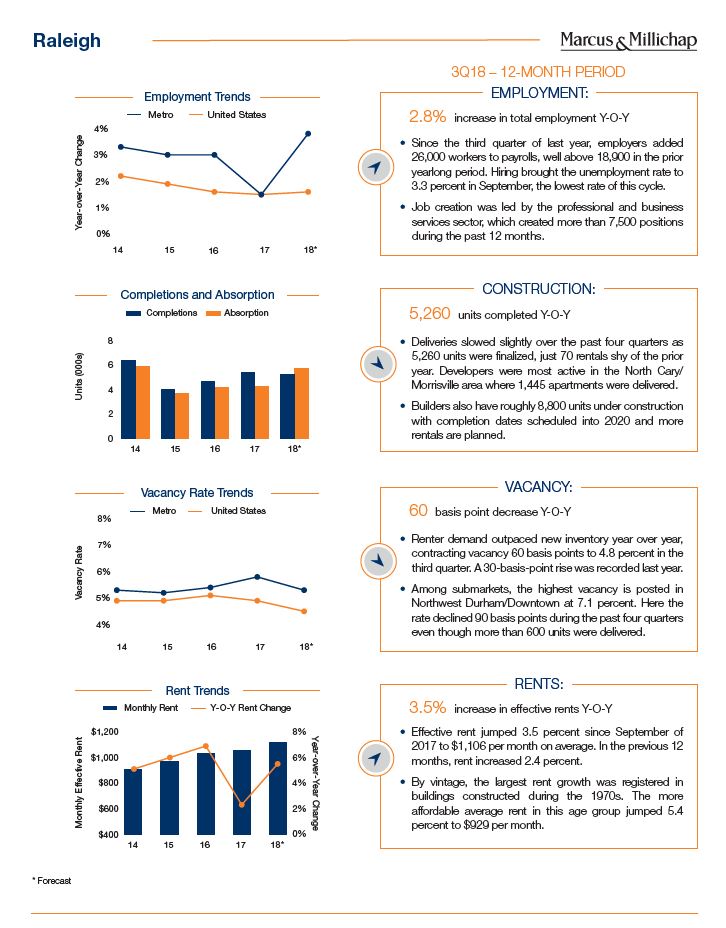

Marcus & Millichap released their 2018Q4 multifamily market report for Raleigh. The study finds that metro vacancy rates contracted 60 basis points to 4.8 percent in the third quarter; average rents increased 3.5 percent to $1,106 this past year.

Researchers attribute this to the robust economic growth taking place in the greater Raleigh area. According to the report: “Since the third quarter of last year, employers added 26,000 workers to payrolls, well above 18,900 in the prior year-long period.”

The Marcus & Millichap study finds that 5,260 apartment units were completed over the past 12 months, just 70 units short of the number of units produced the prior year. Although multifamily production remains high, units are being absorbed quickly. According to the report: “Renter demand outpaced new inventory year over year, contracting vacancy 60 basis points to 4.8 percent in the third quarter.”

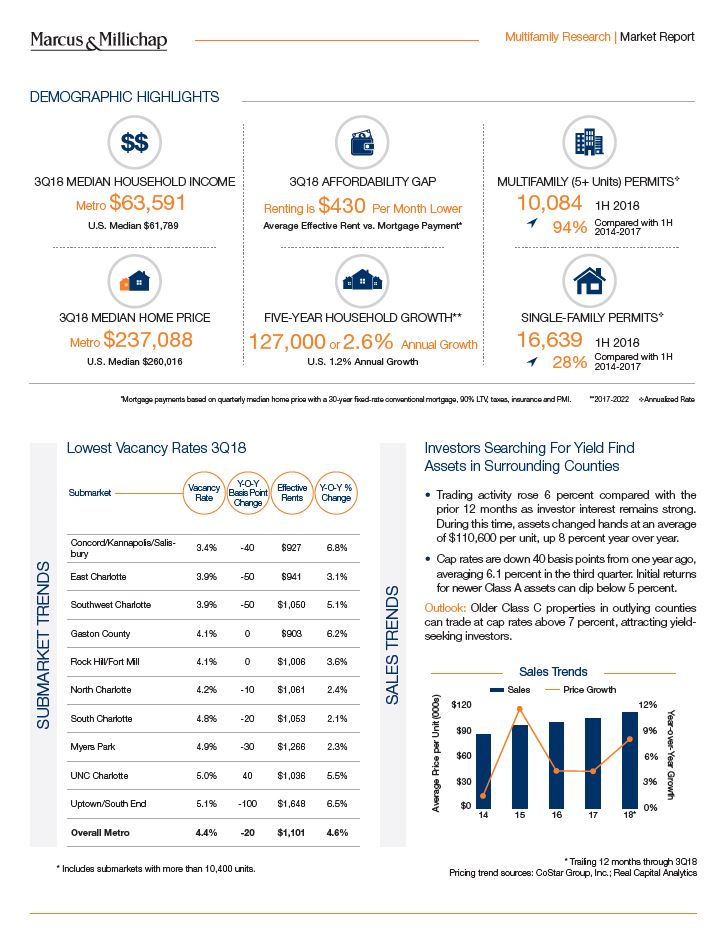

The study finds a $725 monthly affordability gap for renters versus owners and significant demand for older apartment units. According to the report: “By vintage, the largest rent growth was registered in buildings constructed during the 1970s. The more affordable average rent in this age group jumped 5.4 percent to $929 per month.”

This underscores the need for more workforce housing in the greater Raleigh area.

The following link will take you to the Marcus & Millichap report:

https://www.marcusmillichap.com/research/researchreports/reports/2018/11/14/north-carolina-multifamily-market-report